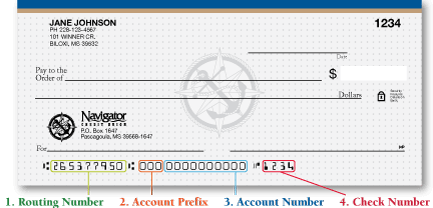

1. Routing Number: this unique nine-digit number is used to identify the financial institution in a transaction. When using your account for purposes of payment or when receiving funds, you can find the routing number on a Navigator check or at www.navigatorcu.org.

2. 3-Digit Prefix: your Checking Account number contains a three-digit prefix to use before your 10-digit account number. This prefix indicates you are using your Checking Account when paying bills by phone or online and to facilitate ACH transactions (any payments such as direct deposit, payroll and vendor transactions.)

3. Account Number: your 10-digit account number is the number for your primary account and should be used for all transactions at a Branch, through online banking or our mobile app.

4. Check Number: this is used as a reference number which will help you track any payment made by check.

Important tip to remember:

When using any account other than your Checking (such as Savings or a Sub Account) to pay bills by phone, online or by ACH, please contact Navigator Credit Union to be sure you have the correct 3-Digit Prefix to use in front of your account number so there is no delay. Navigator Member Service Representatives are available for assistance Monday – Friday from 9 a.m. – 5 p.m. and on Saturdays from 9 a.m. – 1 p.m.

Home

Home